- Crypto Mafia

- Posts

- Bitcoins കൊണ്ട് missiles വാങ്ങാം?🤔

Bitcoins കൊണ്ട് missiles വാങ്ങാം?🤔

PLUS: Big powers, big money, and big changes.

Crypto is no longer just about charts and memes.

It’s now mixed with wars, Wall Street, and global politics.

Let’s Dive Deep ⤵️

🚀 Iran’s Crypto-Powered Arms Sales

Imagine paying for missiles or drones using Bitcoin.

Sounds like a movie scene… but it’s real.

Iran is now saying:

👉 “You can buy our weapons. Pay us in crypto.”

This is happening because Iran is under heavy U.S. sanctions and can’t use normal banks.

📰 What’s New?

Iran updated its weapons export rules

Its defence export body now accepts cryptocurrency as payment

Items for sale include:

Ballistic missiles

Attack drones

Warships

Air-defence systems

Payments can be done using Bitcoin, other crypto, barter, or Iranian money

A Financial Times report revealed this in early January.

🚨 Why It Matters

⚠️ Crypto + weapons = danger

🌍 Governments may tighten crypto rules even more

🏦 Exchanges could face pressure to block certain transactions

📉 Bitcoin could get negative attention from regulators

This shows how crypto can be used to escape sanctions — and that scares governments.

⏭️ What’s Next?

Expect new crypto rules from the U.S. and allies

More wallet blacklists and stricter KYC rules

Watch if other sanctioned countries copy Iran

Crypto is entering serious geopolitical territory.

🏦 BlackRock’s $115 Million Bitcoin Move

While some countries use crypto for war…

Wall Street is quietly buying Bitcoin.

And not just anyone — the biggest asset manager on Earth.

📰 What’s New?

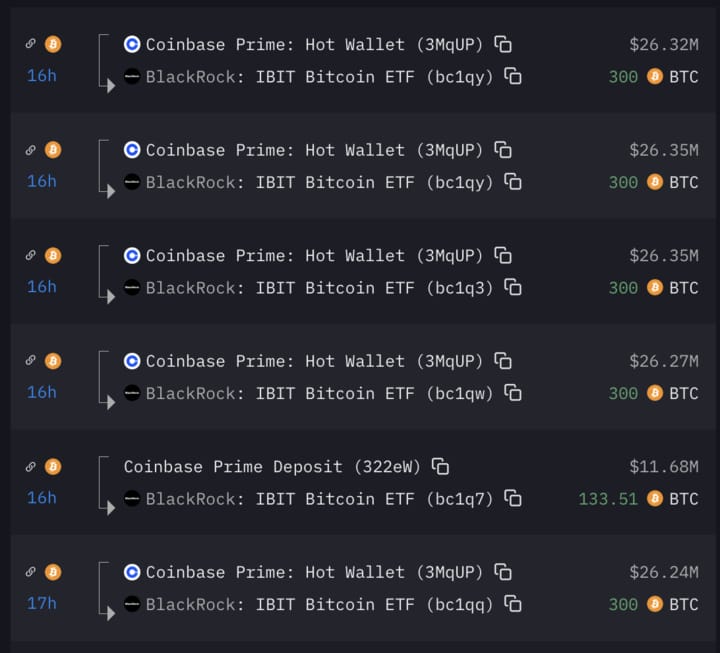

BlackRock moved 1,333 BTC

Value: $115+ million

Timing: Just before New Year’s Eve

Linked to its Bitcoin ETF, IBIT

This was spotted through blockchain tracking.

BlackRock didn’t make a public announcement.

🚨 Why It Matters

🐋 Big institutions are still bullish on Bitcoin

📊 ETFs now control huge Bitcoin supply

🧠 Bitcoin price is influenced by Wall Street flows, not just miners

👥 Retail investors are no longer alone — giants are in control

Bitcoin is becoming financialized.

⏭️ What’s Next?

Watch ETF inflows and outflows closely

January trading will show real direction

If institutions buy more → price support

If they sell → fast drops

Bitcoin now dances to Wall Street music 🎶

🔄 Bitcoin’s 4-Year Cycle Is Breaking

For years, Bitcoin followed a simple rule:

Halving → Pump → Crash → Repeat

But now… that rule is cracking.

📰 What’s New?

The 2024 halving already happened

Bitcoin hit highs in 2025

But no huge crash like before

Experts say:

ETFs

Institutions

Global money flow

Politics

👉 All of this has changed Bitcoin’s behavior

🚨 Why It Matters

⏰ Old “buy and sell by calendar” tricks may fail

🏦 Bitcoin acts more like a stock market asset

📉 Macro news (rates, wars, policy) matters more than halving

🤯 Retail investors may get confused or trapped

The old playbook is outdated.

⏭️ What’s Next?

Watch:

ETF flows

Interest rates

Global tensions

Bitcoin may:

Move slower

Crash less

Or follow stock markets more closely

This is a new Bitcoin era.

🧠 Final Take

Crypto has grown up.

And with that comes power, risk, and control.

🌍 Iran is using crypto to bypass sanctions

🏦 BlackRock is buying Bitcoin quietly

🔄 Bitcoin cycles are no longer simple

Bitcoin is no longer just for geeks.

It’s now part of global finance and global conflict.”

Appo athrollu innathe mafia letter.... Bie! 👋

How was today's MAFIA LETTER? |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research