- Crypto Mafia

- Posts

- Elon vs Trump അടി BTC 📉

Elon vs Trump അടി BTC 📉

PLUS: Latest Crypto News

BTC 105K ninn 101K-il vannu!😳

enthina ee dip?

Here’s the real story:

a combination of Elon Musk and Donald Trump fighting on social media…

Is that the real reason for the dip?

Let’s Dive Deep ⤵️

The Twitter Fight That Shook Bitcoin: Elon vs Trump 🥊

Imagine two billionaires fighting in public – not in private meetings, but directly on Twitter (now called X). That’s exactly what happened:

Trump introduced a new budget plan.

Elon Musk went on X and called it a

“Disgusting abomination.”

Trump hit back saying Elon was

“Wearing thin. I told him to leave.”

Then Elon replied:

“Without me, Trump would have lost the election.”

This public drama between two highly influential people made markets nervous. Investors feared that if these two can’t agree, US policies may become unstable — not good news for crypto.

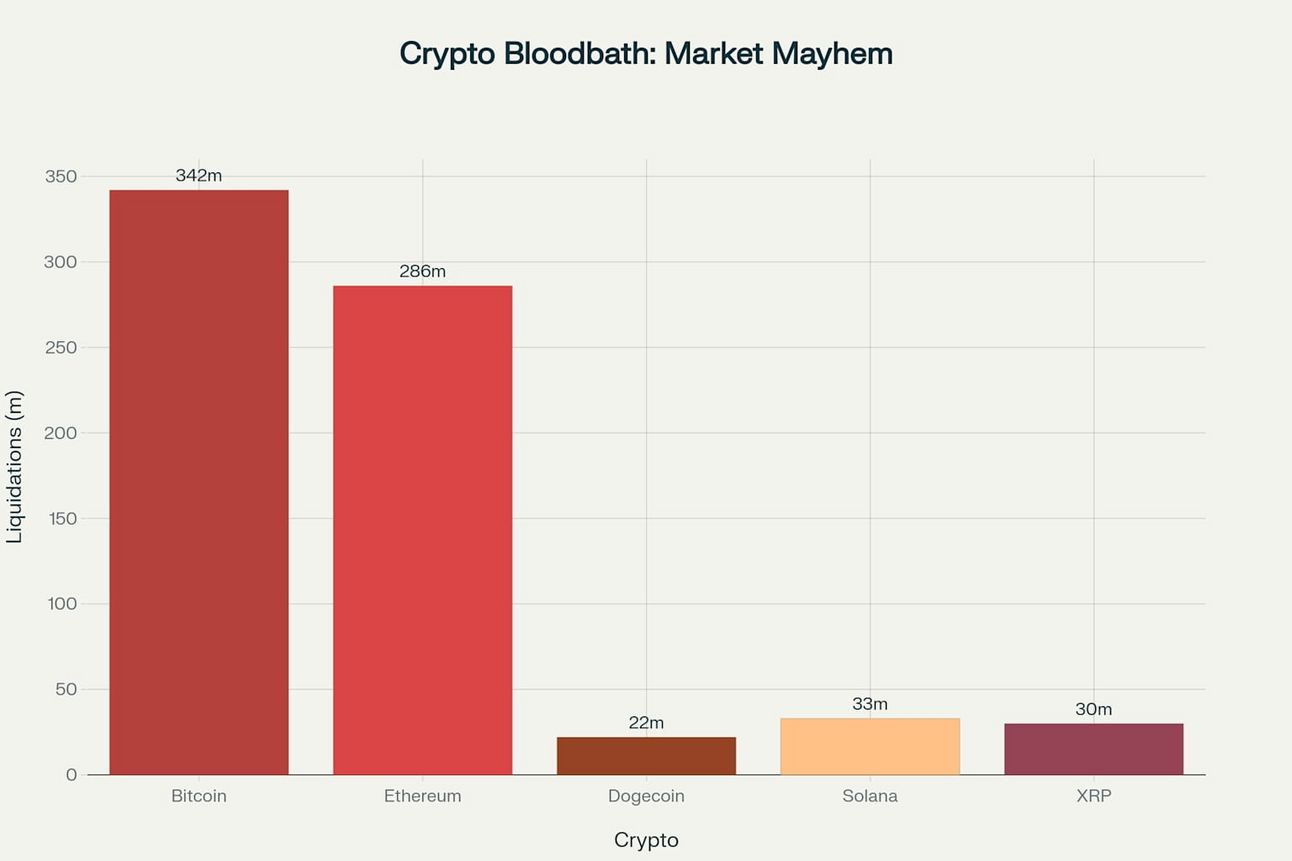

Crypto Market Reaction 📉

Bitcoin: Fell from $105,000 to $101,000 (loss of ₹3 lakh per BTC!)

Dogecoin: Dropped 10% in a single day, 22% over the week

Ethereum: Down 7%

₹8,200 crore liquidated (USD 988 million) 😨

Tesla stock down 14% after Trump’s threat

Quote of the day:

“This was a $980M liquidation storm, all thanks to Trump vs Elon” – Vincent Liu, Kronos Research

From our Partners

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

The Hidden Crash Trigger: Institutional Rebalancing 🧮

The Elon-Trump drama wasn’t the only cause.

There was also institutional rebalancing — a regular process where big funds adjust their portfolios at the end of the month or quarter.

What Is Rebalancing?

Think of it like organizing your room. If you’ve collected too many toys and not enough books, you rebalance — remove some toys, add some books.

Funds do the same. If Bitcoin grows too much compared to stocks or bonds, they sell some BTC and rebalance.

This causes temporary dips in the market.

🔢 The Numbers That Don’t Lie

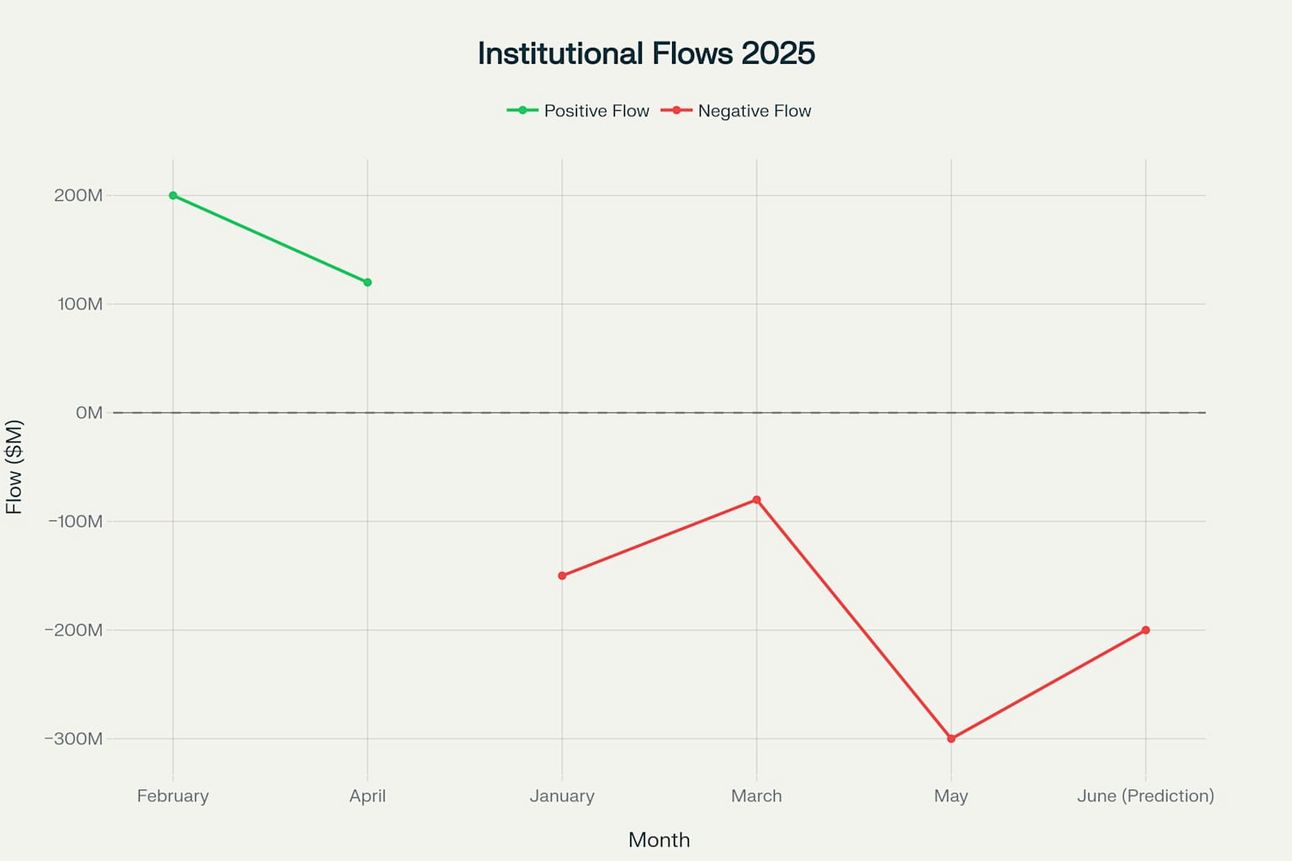

This isn’t just a feeling — the data proves the pattern is real. Rebalancing isn’t some random theory; it actually shakes up the crypto market every time. Let’s break down the proof:

📆 May 2025 Example:

₹2,460 crore institutional outflow mathram kond BTC direct 6.1% crash! 😳

🧠 Pattern Recognition:

March-end, May-end... and now June-end-ilum same scene repeat aavan chance undu. Ee month-end rebalancing cycle consistent aayi BTC market shakin' cheyyunnu.

📉 June 2025 Forecast:

Experts parayunnu—₹1,640 crore (USD 200 million) outflow Q2-end-il expect cheyyunnu. Ippo thanne whales silent aayittund… but last week-le volume spike clue kodukkunnu.

🎯 Success Rate:

Crypto Analytics Firm parayunnu:

"15-20% buying opportunity varum month-end rebalancing-il"

Oru proper plan undenkil, ithu thanne oru jackpot strategy aakum!

🧠 Crypto Mafia Summary:

This Crash Was Temporary, Not the End 💪

This week’s crash was caused by:

Elon and Trump’s very public fight lowering market confidence

Institutional rebalancing selling off Bitcoin ETFs

But don’t panic.

Bitcoin is still above $100K — last year it was at $50K

The long-term growth trend is intact

These events only affect short-term prices

So next time Bitcoin suddenly drops, ask yourself:

“Is this just a temporary dip from drama or rebalancing?”

If yes — breathe easy. Stay calm. And maybe grab some pizza while waiting for the next moon mission 🚀🍕

Appo athrollu innathe mafia letter.... Bie! 👋

How was today's MAFIA LETTER? |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research