- Crypto Mafia

- Posts

- കൊതിപ്പിച്ചിട്ട് കടന്നു കളയുവോ? 🥲

കൊതിപ്പിച്ചിട്ട് കടന്നു കളയുവോ? 🥲

PLUS: Latest Crypto News

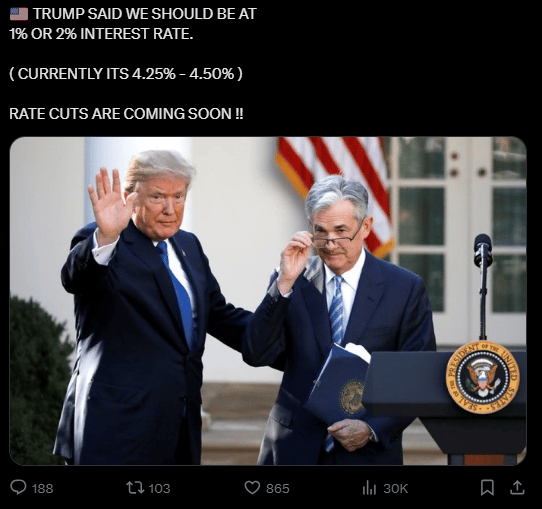

Interest rate 1%- 2% aakumenn trump parayunnu..

Jerome Powell ine replace cheyyan pokunnu..

Bullish for crypto…

Sherikkum enthan ee FED Rate Cuts..

How does it affects crypto?

Lets DIVE DEEP ⤵️

🏦 What is Fed Rates?

Federal Reserve (Fed) ennu parayunnathu USinte central bank aanu.

Fed Rate ennu parayunnathu:

✅ Banks-um banks-um loan edukkunna interest rate

✅ Ithu control cheyyunnathu economy stable aakananu ✅ Higher rates = expensive loans, slower economy

✅ Lower rates = cheaper loans, more investment

Bottom line: When Fed rates go down, it’s easier for money to flow — and that often benefits markets like crypto.

📰 What Happens? | Fed Cut + Crypto

Federal Reserve rate cut ennu paranjal:

✅ Loans cheaper aavum

✅ Investment koodum.. ✅ Risky assets like crypto attract money

In 2020, Fed’s zero rates = Bitcoin surged from ~$7K to ~$69K.

Now, there’s buzz: Fed may cut rates again in 2025.

CME FedWatch suggests possible September 2025 cut.

Crypto markets are ready — Fed pivot could trigger the next rally.

From our Partners

You’ve never experienced business news like this.

Morning Brew delivers business news the way busy professionals want it — quick, clear, and written like a human.

No jargon. No endless paragraphs. Just the day’s most important stories, with a dash of personality that makes them surprisingly fun to read.

No matter your industry, Morning Brew’s daily email keeps you up to speed on the news shaping your career and life—in a way you’ll actually enjoy.

Best part? It’s 100% free. Sign up in 15 seconds, and if you end up missing the long, drawn-out articles of traditional business media, you can always go back.

🚨 Why It Matters for Crypto

💰 Cheaper Money = Risk-On Behavior

Easier money makes risky assets like crypto more appealing

Past bull runs often aligned with Fed easing

🌊 Altcoin Season Potential

Lower rates encourage speculative investing

Smaller coins like ETH, SOL, ADA tend to jump more than Bitcoin

🧠 Market Psychology

Even the expectation of rate cuts can drive crypto prices higher

High rates (like 2022) hurt crypto markets

Relief from the Fed often boosts market confidence

⏭️ What’s Next?

If inflation stays low, Fed may cut soon

Traders watching Powell’s speeches for hints

September 2024 — next possible cut

Market Predictions:

Charles Hoskinson: BTC to $250K

Standard Chartered: BTC $100K – $200K

CMC Markets: ~$112K BTC

Caution: Cuts due to economic weakness may trigger panic — context matters.

🗓️ Fed-Crypto Events:

2017: BTC ~$20K, Fed rate ~1.5%

2018: Rate hike, BTC ~$3K

2019: Rate cut, BTC short rally

2020: COVID cuts, BTC ~$28K

2021: BTC ATH ~$69K, tightening signal

2022: Rate hike, crypto crash

2023: Plateau, BTC ~$25–30K

2024: BTC ATH ~$73K, rate cut hopes

2025: BTC $100K–$250K depending on Fed

💬 Expert Insights:

Dan Raju (Tradier): "High rates scare investors, lower rates boost crypto sentiment"

Charles Hoskinson: "Lower rates could trigger a speculative frenzy in crypto"

Markus Thielen (10x Research): "Rate cuts only help if the economy is stable"

Austin Pickle (Wells Fargo): "First rate cuts often happen during market trouble"

Octavio Sandoval (Illumen Capital): "Fed policy now heavily dictates crypto movements" Key Upcoming Dates

🧠 Crypto Mafia Summary:

🎭 The Debate:

Is Bitcoin really an inflation hedge? Evidence is mixed

Fed cuts = easy money, but also risk of bubbles (as seen in meme coins, NFTs in 2020–21)

Crypto may rally, but timing and market sentiment matter

Conclusion:

Lower rates usually boost crypto prices

But no automatic guarantee of a bull run

Fed’s next moves will define crypto’s future path

Appo athrollu innathe mafia letter.... Bie! 👋

How was today's MAFIA LETTER? |

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research